At Bitcoin Nashville 2024, a prevailing theme among speakers is the role of Bitcoin in safeguarding wealth during times of economic uncertainty.

The discussions highlight Bitcoin's unique properties, which make it a viable hedge against traditional financial system volatility. Speakers emphasize Bitcoin's decentralized nature, limited supply, and independence from central banks as key factors contributing to its resilience and reliability as a store of value.

Understanding Bitcoin's Role in Protecting Wealth

Bitcoin has emerged as a prominent tool for protecting wealth, especially during times of economic uncertainty. Unlike traditional financial assets, Bitcoin's unique characteristics provide several advantages that make it an attractive hedge against economic volatility.

Decentralization:

One of Bitcoin's key features is its decentralized nature. Unlike traditional currencies, which are controlled by central banks and governments, Bitcoin operates on a decentralized network of nodes. This means that no single entity can manipulate its value or supply, making it less susceptible to political and economic pressures.

Limited Supply:

Bitcoin's supply is capped at 21 million coins, ensuring its scarcity. This limited supply safeguards against inflation, which erodes the value of traditional fiat currencies over time. As central banks around the world continue to print money to address economic challenges, Bitcoin's fixed supply becomes increasingly valuable.

Independence from Central Banks:

Bitcoin operates independently of central banks, which often engage in monetary policies that can devalue traditional currencies. By holding Bitcoin, individuals can protect their wealth from the adverse effects of such policies, including inflation and currency devaluation.

Xapo Bank’s Strategies for Helping Users Maintain Purchasing Power

Xapo Bank has positioned itself at the forefront of the financial revolution by integrating Bitcoin with traditional banking services. Here are some of the strategies Xapo Bank employs to help users maintain their purchasing power:

Hybrid Accounts:

Xapo Bank offers accounts that allow users to hold, transact, and earn interest in Bitcoin alongside traditional currencies such as USD, EUR, and GBP. This hybrid approach provides users with the flexibility to benefit from Bitcoin’s potential appreciation while enjoying the stability and liquidity of fiat currencies.

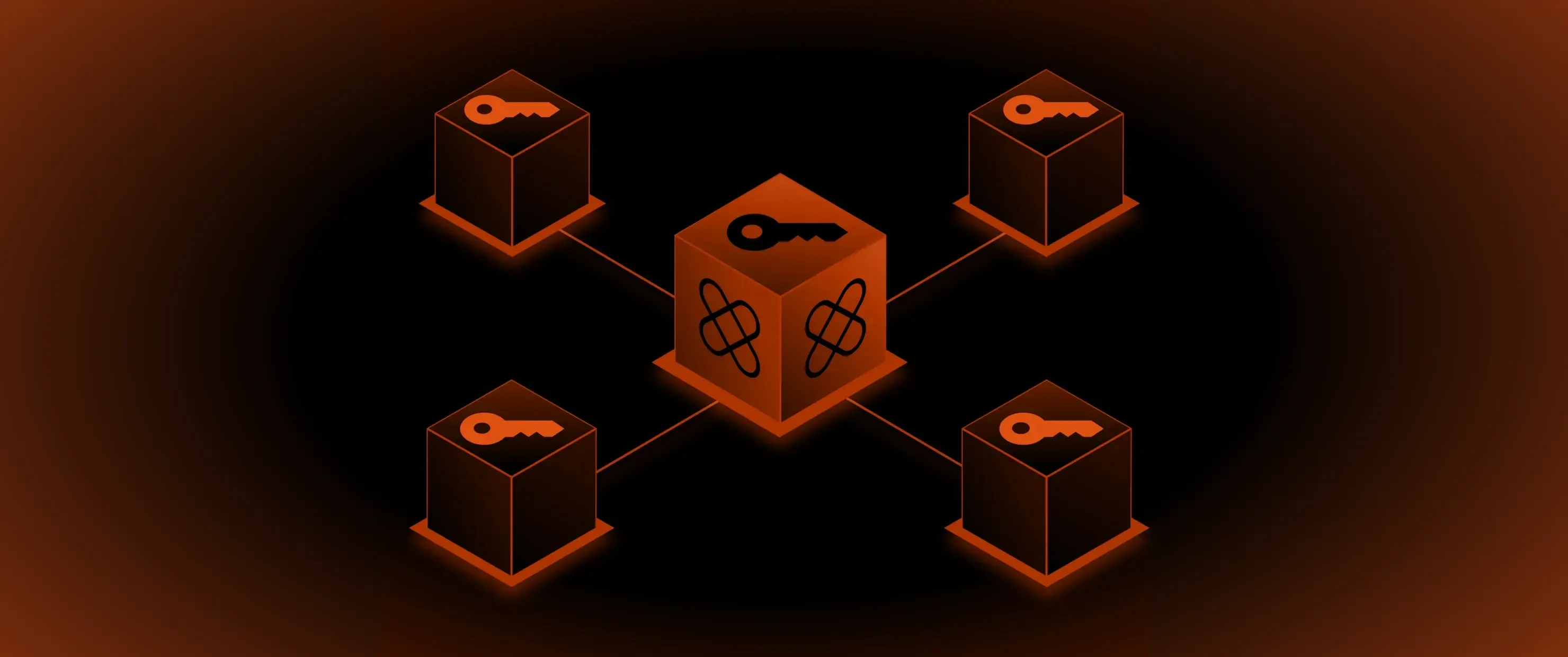

Security and Compliance:

Security is a top priority for Xapo Bank. The bank uses advanced security measures, including Multi-Party Computation (MPC) protocols, to protect users' assets. Additionally, Xapo Bank adheres to strict regulatory standards to ensure compliance with financial laws and regulations, providing users with peace of mind.

Integration with the Lightning Network:

To enhance Bitcoin's utility for everyday transactions, Xapo Bank leverages the Lightning Network. This technology enables instant and low-cost Bitcoin transactions, making it practical for users to spend their Bitcoin in daily life.

Xapo Bank leverages the Lightning Network. This technology enables instant and low-cost Bitcoin transactions, making it practical for users to spend their Bitcoin in daily life.

Real-World Examples of Bitcoin’s Resilience in Volatile Markets

Bitcoin's performance during economic downturns provides real-world evidence of its resilience. Here are a few examples:

2020 Market Crash:

During the market crash triggered by the COVID-19 pandemic in 2020, global stock markets experienced significant declines. In contrast, Bitcoin demonstrated remarkable resilience. Although it initially dropped in value, Bitcoin quickly recovered and reached new all-time highs by the end of the year. This recovery highlighted Bitcoin's ability to act as a hedge against traditional market risks.

Inflation Hedge:

In countries experiencing hyperinflation, Bitcoin has become a valuable tool for preserving wealth. Citizens in these countries have turned to Bitcoin to protect their savings from the rapid devaluation of their national currencies. Bitcoin's global accessibility and limited supply make it an effective hedge against inflation.

Outlook and Adoption Trends

The growing acceptance of Bitcoin by both individuals and institutions underscores its potential as a hedge against economic uncertainty. Here are some key trends:

Institutional Adoption:

Major financial institutions and corporations increasingly recognise Bitcoin's value as a hedge. Companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, citing its potential to preserve value in an inflationary environment. This institutional adoption signals confidence in Bitcoin's long-term prospects.

Policy and Regulation:

The increasing involvement of policymakers in the crypto space is a positive sign for Bitcoin’s future. Governments around the world are developing regulatory frameworks to govern digital assets, providing greater clarity and legitimacy. This regulatory acceptance is expected to drive further adoption of Bitcoin as a mainstream financial asset.

Public Awareness:

Public awareness and acceptance of Bitcoin continue to grow. More people are recognizing Bitcoin as a viable alternative to traditional financial assets, especially in regions with unstable economies. As awareness increases, so does adoption, further solidifying Bitcoin's role as a hedge against economic uncertainty.

Conclusion

Bitcoin's unique properties are making it an attractive hedge against economic uncertainty. Xapo Bank's innovative strategies, including hybrid accounts, robust security measures, and integration with the Lightning Network, empower users to protect and grow their wealth through Bitcoin. As adoption trends continue to rise and regulatory frameworks evolve, Bitcoin is poised to play an increasingly important role in the global financial landscape.

.webp?cache=1769694702440)