Once dismissed as a fad, Bitcoin is now sitting on the balance sheets of some of the world’s biggest companies, and inside investment products from finance’s most established names. What started as a digital experiment has become a serious tool for protecting and growing wealth – and traditional finance’s change of heart has been astonishing.

The institutional wake-up call This shift didn’t happen overnight. Early adopters saw Bitcoin as a shield against inflation and currency weakness. Now, the biggest players are stepping in.

Asset managers & ETFs: The arrival of spot Bitcoin ETFs in the US – from names like BlackRock and Fidelity – was a watershed moment. These products let investors buy Bitcoin through the same platforms they use for stocks and bonds. It’s a sign that the very core of traditional finance now sees Bitcoin as part of the investment conversation.

Corporate treasuries: Businesses are buying Bitcoin to strengthen their balance sheets. The idea is simple: holding Bitcoin instead of cash can protect against inflation and the Bitcoin itself may even grow in value over time. Companies like MicroStrategy, GameStop and Robinhood have also seen the PR boost that comes with such a move.

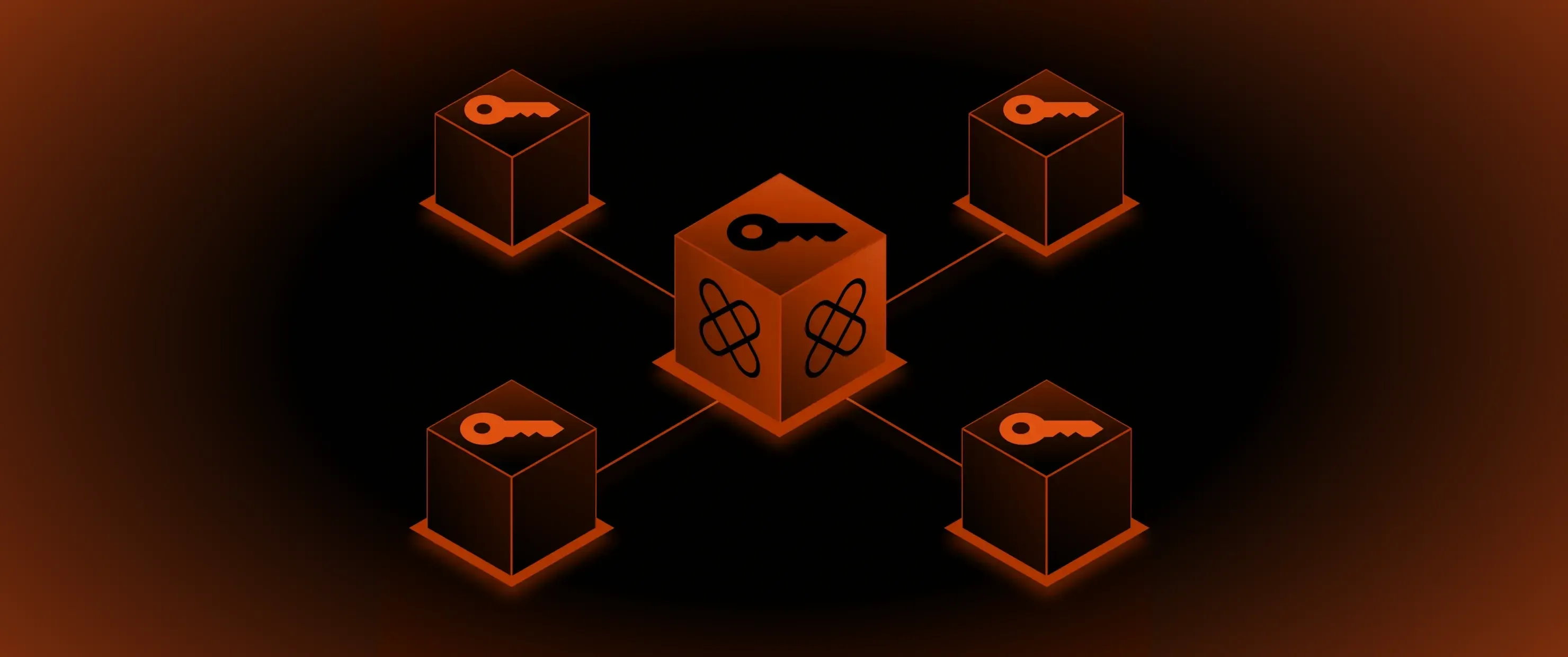

Banks & financial services: The same institutions that once kept Bitcoin at arm’s length are now offering it to their wealthiest clients. BNY Mellon, Morgan Stanley and others now provide Bitcoin custody and investment options – not out of charity, but because their clients are asking for it.

Beyond the price chart Institutional involvement has reshaped the market in ways that go well beyond Bitcoin’s price.

More liquidity, less wild swings: More money in the market means smoother trading and, in many cases, less volatility than Bitcoin’s early days.

Better infrastructure: Institutional demand has driven the creation of stronger custody, compliance and trading systems – which benefits everyone, not just big players.

Clearer rules: As institutions have joined in, regulators have been pushed to define clearer frameworks for how Bitcoin can be used and held.

A global (but uneven) shift In the US, ETFs are the new entry point for institutions. In emerging markets, some companies are treating Bitcoin as a lifeline against unstable local currencies. Corporate strategies vary, but many are now taking a measured approach, allocating a small slice of reserves or portfolios to Bitcoin instead of going all-in.

Where Xapo Bank fits in We’ve been bridging Bitcoin and traditional banking for over a decade, giving members and corporate accounts secure access to both worlds in one place.

As more institutions adopt Bitcoin, the opportunities grow too. We provide the platform, security, and expertise to help you participate with confidence.