Flexibility and liquidity are often hard to find together, but they can be important factors when planning to buy a home, start a business, or simply fund your lifestyle. By using your Bitcoin to borrow US Dollars, you can enjoy both—accessing the funds you need while keeping your Bitcoin secure and ready for the future. Xapo Bank offers a powerful alternative to traditional loans, allowing you to borrow US Dollars with your Bitcoin as collateral. Let’s dive deeper.

Why borrow US Dollars with your Bitcoin?

Using your Bitcoin to borrow cash represents a significant departure from traditional models. At Xapo Bank, BTC collateral loans enables you to leverage your holdings as collateral to borrow cash in the form of US Dollars. This means you can access funds quickly and efficiently without the need for lengthy approval processes or high interest rates.

But what truly sets BTC collateral loans apart is the flexibility they offer. Unlike traditional loans, where the terms are rigid and repayment schedules are often strict, borrowing with Bitcoin allows you to set the pace. You have the freedom to choose the loan duration, repayment schedule, and amounts that work best for your financial situation. This flexibility empowers you to take control of your finances, making it easier to achieve your goals on your terms.

The power of financial freedom

Using your Bitcoin to borrow US Dollars gives you the financial agility to pursue your goals confidently, whether they're seizing new opportunities or creating a secure future.

The power of financial freedom is in your hands, and Xapo Bank is here to help you make the most of it.

Our Bitcoin-backed loans are designed to empower you to live the life you want, without having to sell your valuable Bitcoin holdings.

How do BTC collateral loans compare to traditional loans?

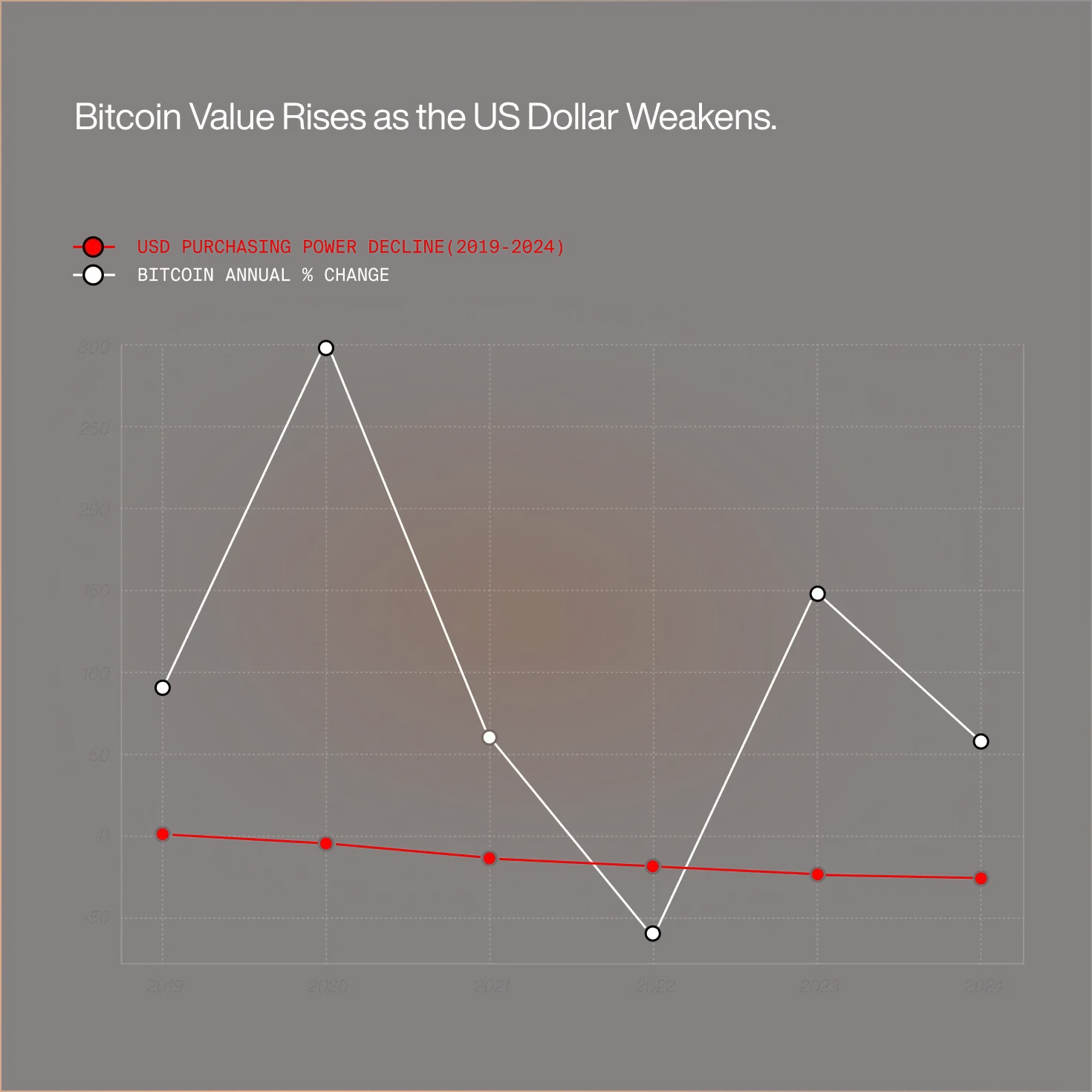

When comparing Bitcoin-backed loans to traditional loans, the benefits are clear. Traditional loans often come with high interest rates, rigid repayment schedules, and lengthy approval processes. They also typically require a strong credit history, which can be a barrier for many people.

Borrowing with Bitcoin, on the other hand, offers a more accessible and flexible option. Because your Bitcoin is used as collateral, the loan approval process is swift, and you can access your funds within seconds, making it an ideal solution for those who need fast liquidity.

Additionally, your Bitcoin collateral stays secure in our BTC Vault, giving you the chance to benefit from its potential growth while you use the funds for your financial needs.

The future of financial empowerment

At Xapo Bank, we believe that borrowing with Bitcoin is more than just a financial product—it’s a tool for empowerment. By providing you with the flexibility and freedom to manage your finances on your terms, we aim to help you achieve financial agility and build a brighter future.

Whether you're eying a major purchase, investing in your future, or simply seeking more control over your finances, borrowing with your Bitcoin offers a unique and transformative solution. And with Xapo Bank by your side, you can feel confident that your assets are safe and your financial future is in good hands.

.webp?cache=1772186406235)