The $84 Trillion Shift: Why the Great Wealth Transfer is Bitcoin's next great moment

The largest transfer of wealth in human history is underway. To understand what this means for the future of money, Xapo Bank has published a new Thought Leadership Report: "The Impact of the Great Wealth Transfer on Bitcoin."

Our report examines how an estimated $84 trillion will pass from Baby Boomers to younger generations over the next two decades. This shift will reshape the way families manage and grow wealth.

At the heart of this change is Bitcoin. It's now seen as a key part of a modern investment plan. As younger, tech-savvy generations inherit this wealth, they are bringing fresh ideas about what makes a good long-term investment and how to protect its value.

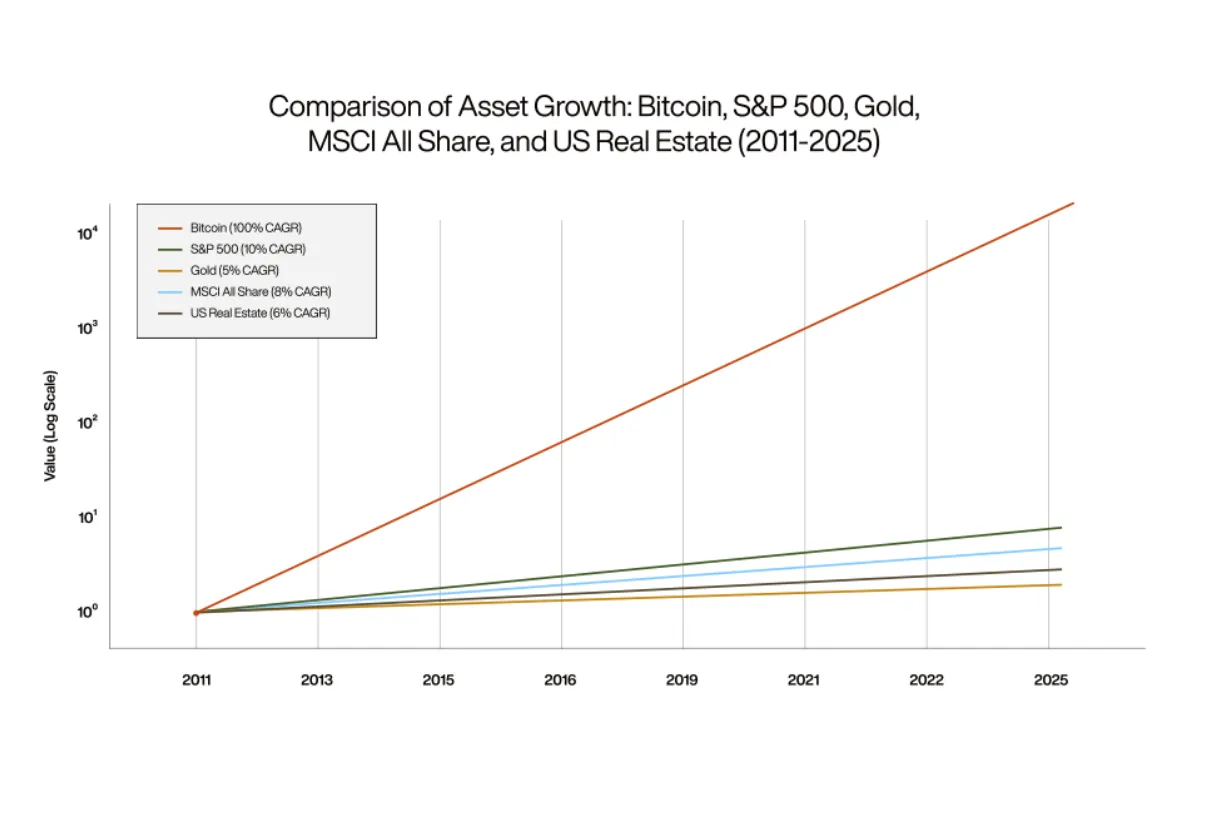

Over the past five years, Bitcoin has significantly outperformed gold as an asset class in terms of returns (+1,198.5% vs +64.1%).

A new generation, a new investment philosophy

The people inheriting this money handle their finances very differently from their parents' generation. Younger people are three times more likely to invest in things other than traditional stocks and shares. They care about innovation, and many prefer investments that are decentralised and purpose-driven.

This change in attitude is creating a big boost for Bitcoin. This massive wealth transfer could result in $160 billion to $225 billion flowing into crypto. That could create an extra $20 million to $28 million in buying activity for Bitcoin every single day.

At Xapo Bank, we see this change happening among our own clients.

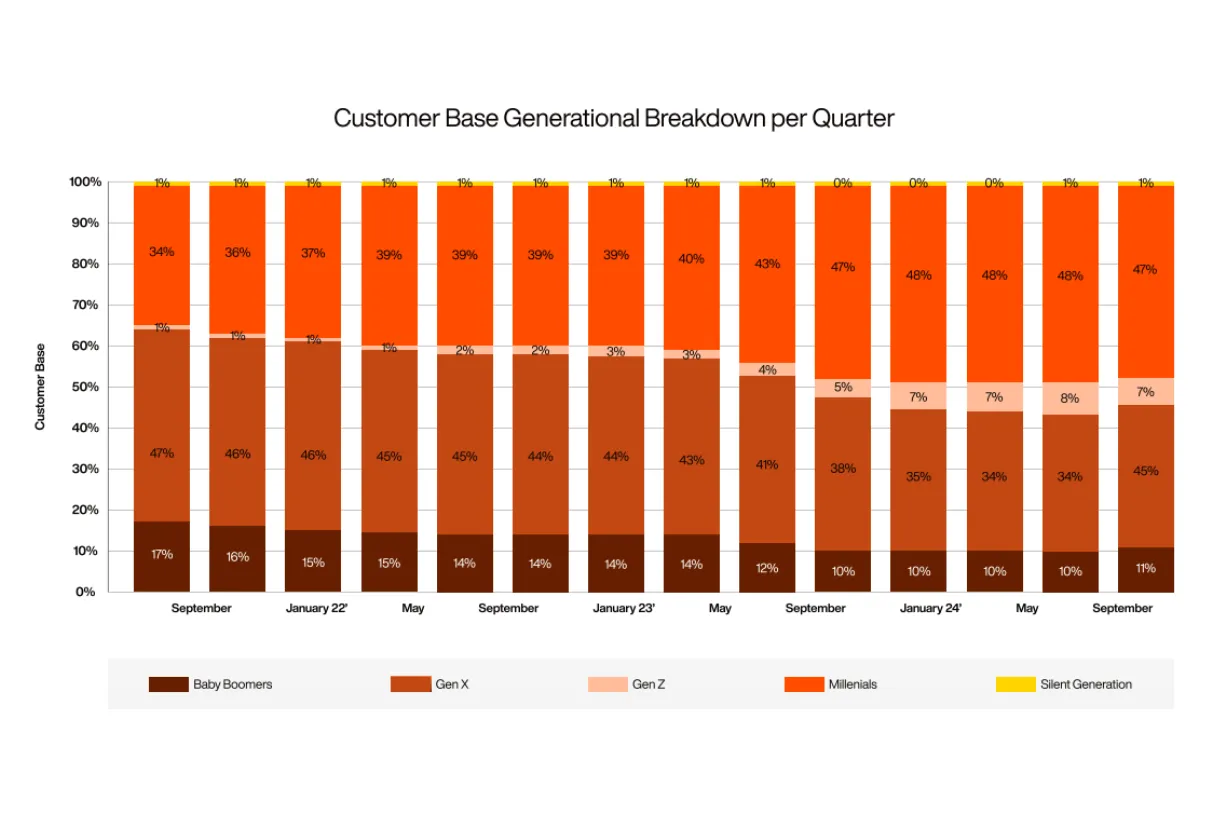

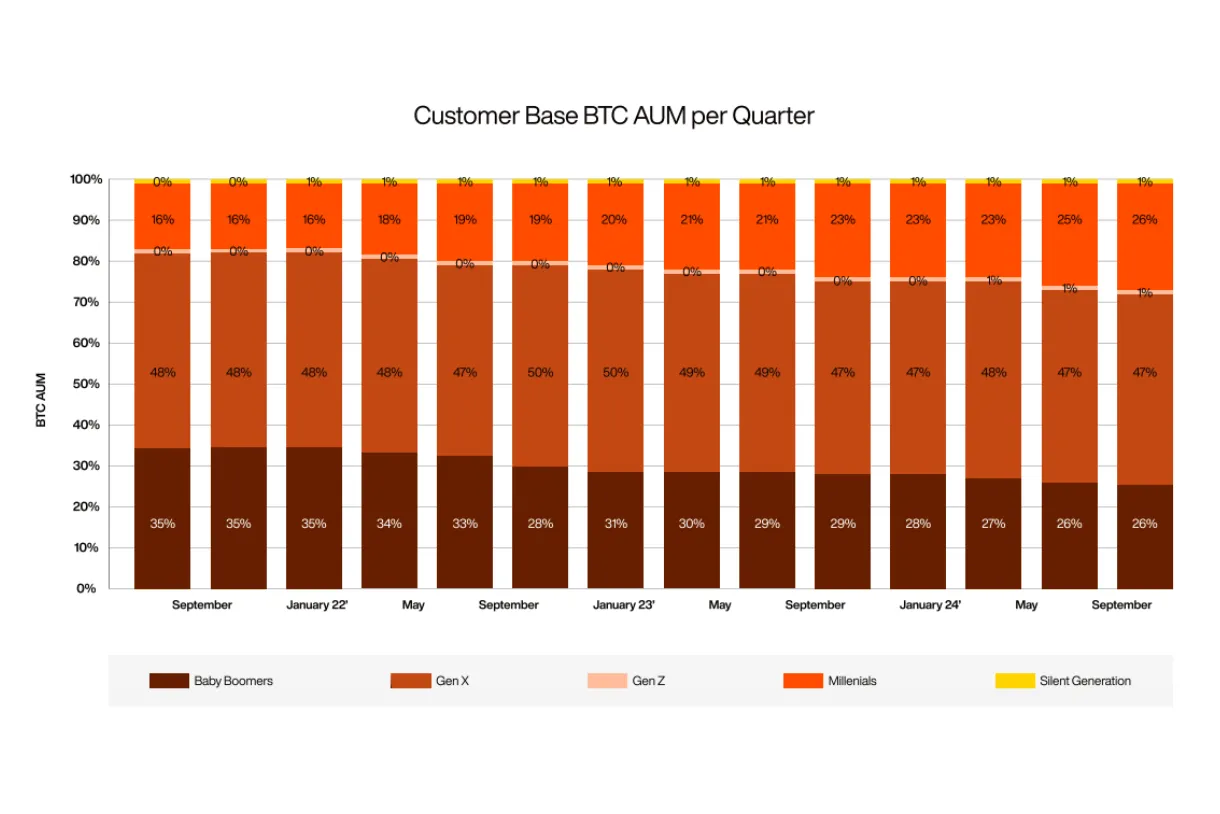

Millennials now make up 47% of our customers (up from 34% in 2021).

Together, Millennials and Gen X account for 82% of our base – a clear sign that wealth management is going digital.

The Inheritance Paradox: Bitcoin's Greatest Challenge

As more people buy Bitcoin with their inherited wealth, it’s important to look further ahead. Those already holding Bitcoin need to think about how it will be passed down. And those planning to buy it should also consider how they will secure it for the next generation.

Bitcoin is a great way to store wealth because it's not controlled by any single country and there's a limited amount of it. However, these exact features make it very difficult to pass on to others. While leaving traditional assets like property or stocks is simple, inheriting Bitcoin can be full of risks:

Losing private keys: Think of a private key as the one and only key to a digital vault. If it's lost, the Bitcoin inside is gone forever. The Wall Street Journal estimates that nearly 20% of all Bitcoin might already be lost, often because the owner passed away without leaving instructions on how to access it.

Crime and scams: Digital assets are a big target for criminals. In 2022 alone, around $5.9 billion was lost to crypto scams. Heirs who aren't familiar with digital security can be easy targets.

Exchange failures: Leaving your crypto on an exchange means you're trusting that company to keep it safe. But if the exchange goes out of business, like Mt. Gox or FTX did, your money could disappear with it, with no way to get it back.

Legal gaps: A standard will often can't be used to pass on Bitcoin. Without specific, secure instructions on how to access the keys, your loved ones may not be able to inherit your digital wealth. For example, the family of banking heir Matthew Mellon reportedly couldn't access most of his $500 million crypto fortune after his death because of poor planning.

How the Xapo Bank app helps you secure your digital legacy

Most traditional banks are not ready to manage digital inheritance. The Xapo Bank app was built to fill this gap as a regulated, crypto-native institution.

We created the Bitcoin Beneficiaries feature, which allows members to designate heirs and help ensure Bitcoin wealth is passed on securely.

Key protections include:

Institutional-grade custody with institutional-level compliance.

Advanced MPC technology to remove single points of failure.

A secure framework designed specifically for passing on Bitcoin.

Our data shows that wealthier clients are especially proactive about inheritance planning:

32% of “Flagship” clients are interested in our Bitcoin Beneficiaries feature.

Compared to 19% of “Established” clients and 13% of “Emerging” clients.

The future of wealth is here

The Great Wealth Transfer is accelerating Bitcoin’s role as a core asset for generational wealth preservation. For today’s investors, the key is not just buying Bitcoin, but also ensuring it can be securely passed on.

The lesson is clear: traditional inheritance planning isn’t enough for Bitcoin. At Xapo Bank, we’re ensuring digital wealth doesn’t get lost – it grows across generations.

.webp?cache=1770396846499)