When Satoshi Nakamoto published the Bitcoin whitepaper in 2008, the vision was clear:

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution."

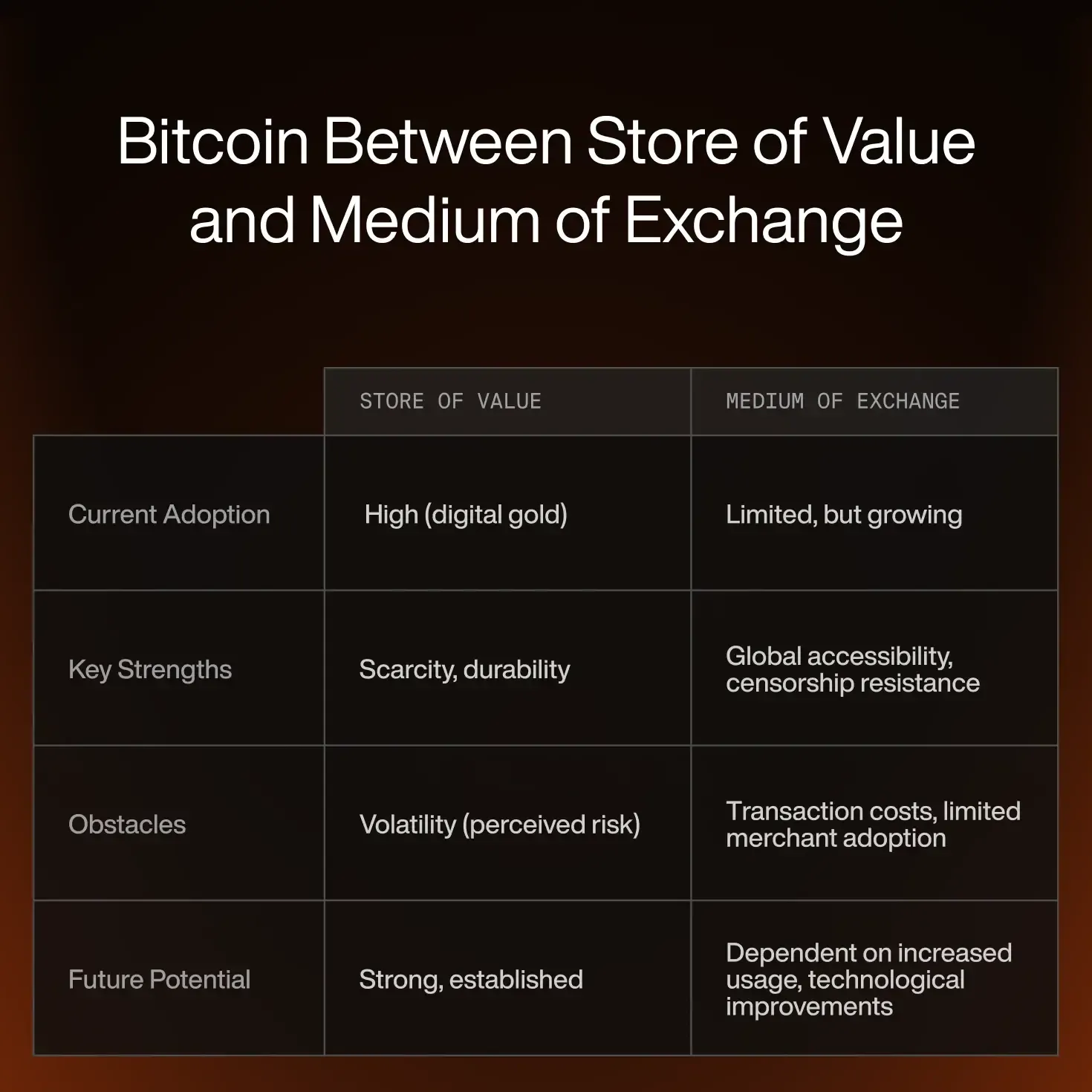

Although Bitcoin was designed to substitute the traditional fiat currencies, it’s more often viewed as a store of value instead of a medium of exchange. This differs from Satoshi’s original vision and has sparked a debate across the Bitcoin community about whether Bitcoin adoption should move towards the so-called medium of exchange system.

In this article, we will explore how Xapo Bank is focused on helping Bitcoin to fulfill Satoshi’s vision while also taking into account the current Bitcoin adoption stage by offering unique services, but let’s first review what a store of value and medium of exchange are.

What is a store of value?

A store of value is an asset, commodity, or currency that can be saved, retrieved, and exchanged in the future without deteriorating in value. The essential characteristic of a store of value is its ability to maintain purchasing power over time, meaning it does not depreciate significantly and remains useful in the long term.

Traditional examples include gold, silver and precious metals, but Bitcoin, due to its limited supply, decentralised and digital nature, enhances its appeal as an alternative, especially in a world where traditional stores of value may be subject to inflation, confiscation, or logistical challenges.

What is a medium of exchange?

A medium of exchange is any item or system widely accepted as payment for goods and services, acting as an intermediary in transactions to facilitate trade between parties. In modern economies, this is typically currency that in order to function well as a medium of exchange, it should be widely accepted by participants in the economy, easily recognisable and portable, reasonably stable in value, divisible into smaller units and not easily counterfeited.

The current Bitcoin narrative is the store of value

Michael Saylor, the executive chairman of MicroStrategy, widely promotes Bitcoin as digital gold, where people should buy and never sell it. On the other hand, we have Jack Dorsey, co-founder of Twitter (X), using the argument that for Bitcoin to substitute the current financial system, it has to be used as a medium of exchange. Both parties and their followers have very strong arguments supporting their views.

Proponents of the store of value narrative state the whopping average ~49% annual return that Bitcoin has delivered in the past 15 years and the lack of incentives to spend or sell the already acquired Bitcoin. Proponents of the medium of exchange narrative say that the blockchain fees consumed by miners are a critical part of the Bitcoin decentralised system, stimulating more participants in the network and increasing the overall network robustness. They state that without transactions and the respective fees, miners won’t be motivated to operate, which will ultimately make the Bitcoin network vulnerable to bad actors.

Bitcoin, being a store of value, doesn’t exclude the medium of exchange use case. Both can work simultaneously, but it’s a fact that in the past few years, more people have viewed Bitcoin primarily as a store of value. Xapo Bank was established in 2013 with a clear focus on helping Bitcoin succeed, and we have built unique features covering both narratives.

Both store of value and medium of exchange with Xapo Bank

At Xapo Bank, we believe that Bitcoin must work for you, no matter if you see it solely as a store of value or as a medium of exchange. That’s why we make it simple and seamless to buy Bitcoin directly through the Xapo Bank app, offering highly competitive rates - with a spread of only 0.1% above the market spread, to help you get the most Bitcoin for your money .

Once a Xapo Bank member holds Bitcoin, they can earn up to 0.0% yield paid daily in BTC. Xapo Bank offers institutional-grade security, making it the optimal place to buy and securely store your digital gold.

Bitcoin HODLers are resistant to sell their digital gold, and Xapo Bank is one of the first financial institutions to enable its members to borrow up to $1M and use their Bitcoin as a collateral. By borrowing against their Bitcoin, Xapo Bank members can face their liquidity needs without selling their Bitcoin.

For Bitcoin to become the preferred medium of exchange and substitute fiat, the network transactions should be instant with near-zero costs. Layer 2 protocols such as Lightning Network (LN) solve this problem and Xapo Bank has become the first regulated financial institution to enable Lightning payments. Even though the LN adoption was relatively low in 2023, Xapo Bank’s main objective was to increase awareness by announcing that Bitcoin can be used to pay for everyday purchases. The initiative paid off, and we see that over 27.6% of Bitcoin withdrawal transactions via Xapo Bank app are done on LN, which is a strong indicator of LN adoption by users.

Xapo Bank also enables its members to spend their Bitcoin directly from the Xapo Bank debit card. Members can pay with their card by using their Bitcoin, even if they don’t hold any fiat.

Even though currently Bitcoin is viewed primarily as a store of value, given its widespread use for wealth preservation and its strong attributes, it is also emerging as a medium of exchange, especially in niche environments and has the technological and economic potential to expand in this role as adoption increases and transactional infrastructure improves.

Ultimately, we believe that Bitcoin will fulfill both use cases and we’re focused on accelerating Bitcoin adoption for users viewing it as a store of value while we’re investing in the infrastructure needed to use the Bitcoin network as a medium of exchange. Initiatives such as UMA, aiming to replace the current legacy international payment systems, are based on the vision that Bitcoin will be the world’s preferred medium of exchange very soon.